The most common misconceptions among Filipinos is they think that a business name registration means they already have a legal business. Oftentimes this process is done online and can take only a few minutes.

While that is the dream, to get a business up-and-running as quickly added possible, the ease of doing business in the Philippines still has a long way to go.

Completing a business name registration, either through the Department of Trade and Industry (DTI) or Securities and Exchange Commission (SEC), is simply the first step of legalizing your business.

What the business registration process looks like

The complete business registration process involves four key steps:

- Name reservation and approval via the governing entity

- Obtaining a barangay permit

- Securing the local government (city) clearance

- Getting a certificate of registration and your receipts/invoices

If you will employ some staff, you’d need to register with different government agencies; Or if you have special licensing needed like if you’re a financing or lending company; but generally speaking, once you complete these four steps, you already have a legal business with all the necessary permits and licenses to operate.

A common misconception

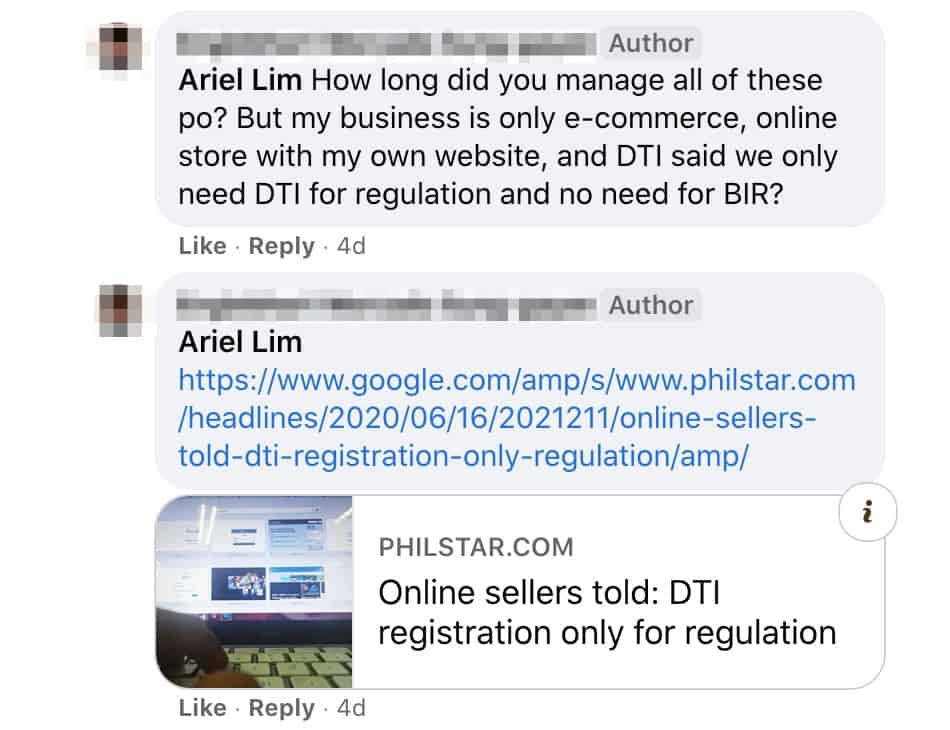

Search through Facebook and other groups and you’d find this prevalent. Take a look at this conversation I had a few days ago who was asking about DTI registration.

There’s a lot of blame to go around, but that won’t solve the problem. The only thing we can do is move forward and find the information that really matters. You can find everything you need to know right here.

But here’s where I draw the line: journalism. They have the responsibility to share accurate news. After all, that’s the job itself.

Here’s a snippet of the article mentioned in that thread.

When Juan already doesn’t know where to get the proper information for his business and when you add misleading headlines from reputable newspapers, you’ve got a recipe for disaster.

Unfortunately, these newspapers wear their marketing hats more than their journalist ones. The try garnering more clicks and views and shares without thinking through the repercussions of misleading headlines.

The article is correct technically. But it’s presented in a format that’s difficult to understand. And if you don’t go past the headline, which 80% of people don’t, people will think the headline as true.

That’s why I decided to start making this website so everyone who needs information about starting their business will have the right answer.

Registration is different from taxation

DTI registration only reserves your name, it doesn’t legalize your business

A key concept that online sellers (or anybody who plans of starting a business) need to know is that registration is different from taxation. That’s really the two concepts the article was trying to say:

- Online sellers need to register with the Department of Trade and Industry

- But they don’t necessarily have to pay taxes

Registering your eCommerce shop with the DTI is the first step in legitimizing your business. Whether you’re only selling through Lazada or Shoppee, if you earn income from it, that is taxable. And the only way to be taxed is to register it with the proper governing entity.

The same principle applies with businesses covered by the Securities and Exchange Commission (SEC). When you complete a SEC name reservation, you only finished that first step. You are not a company nor a legal business yet.

Check domain name availability before you register your name

One tip I recommend is you check the availability of your chosen brand or company name online. Doing this extra step helps you build your brand later on.

A website is no longer a nice-to-have. It’s a requirement for businesses who want to succeed. Rarely will you find a business—large or small—that is successful without a website. That’s why it’s essential that you go through this step.

Just type in your brand name and you can see if it’s available or not. You’ll also

You can either reserve the name now, or do it immediately after your name is approved in either the DTI or SEC registration. This way, no one else can use it aside from you.

And while you’re there, start canvassing some web hosting providers. That way, you can get an idea as to what your next steps are once your name is approved.

Web hosts are where your website lives. Think of it as choosing a storage provider like Dropbox or Google Drive or iCloud. You may use different devices, but all your files are in one place. That’s essentially what web hosts are.

One that I have been using since 2011 is InMotion Hosting. They aren’t the best, but they aren’t the worst either. It’s a good starter web host that has great customer support.

Business registration and paying taxes isn’t just a hassle to small businesses, it’s your duty

Again, simply going through social media and you’ll find a bunch of comments on how registration is a hassle (alongside the misinformation).

Whenever I read at comments like these, I just roll my eyes because clearly these people don’t know how businesses fit in the bigger picture.

Yes, I agree registering a business isn’t as easy as it should be. There’s no denying that. It can take a weeks to finish the entire registration process. Compare that with singapore where you can complete an incorporation within 24 hours.

Different cities, municipalities, and government agencies all have different policies and procedures. In most cases, it also comes down to the individual person processing the application.

But despite all that, there’s no reason for you not to comply with these requirements. It’s the law. If you engage in business and don’t have the proper permits, you’re only putting yourself in unnecessary risks.

Businesses pay taxes to the government. The government provides essential services to its people. That’s how the economy works.

A great way to think about whether a decision is justified or not is using a concept from utilitarianism.

Utilitarianism is a family of normative ethical theories that promotes actions that maximize happiness and well-being for all affected individuals…the basic idea behind all of them is to in some sense maximize utility, which is often defined in terms of well-being or related concepts.

—Wikipedia

Ask yourself this question: “if every business doesn’t pay taxes, will this be beneficial for everybody?”

The answer is most likely no. The government will not have funds for its projects, which will then lead to more debt, which will eventually lead to a financial crisis. And financial crisis, if you don’t know, are usually accompanied by high unemployment rates. Meaning, there’s be less money available for spending overall.

Bottom line: you have to register your business. There’s no way around it.

You can get away with not registering your business and paying taxes, but why put yourself at risk?

On the other hand, I understand where Pinoys are coming from. A lot are skeptical.

- I’m only a small business

- I’m not earning millions

- My taxes will just go to corrupt government officials

- If my neighbor is not registered, why should I register?

All are valid points. But they are irrelevant.

Go back to the utilitarianism exercise above.

Look, the fact is, those stories you hear are merely the tip of the iceberg. There’s a lot of things that go unnoticed. For example, I recently saw in another Facebook group about what laws do you want to pass that’s specific to businesses. People commented on specific startup laws like government assistance, etc.

Did you know there’s already one called the Innovation Startup Act? It was authored in 2018 and passed in 2019.

That’s why you also have to do your part.

You’re only putting yourself and your business at risk if you engage in business without permits and licenses. At the minimum, you’ll face late penalties for registration. Worse, you could be charged for tax evasion, which is a criminal offense (aka potential jail time).

Over to You

Reserving your name via DTI or SEC is only the first step. Don’t stop there. You still have to complete the entire registration process if you want to eliminate the risk to yourself and your business. Plus, it’s also your duty.

Also remember that registration is different from taxation. When you register a business, you don’t necessarily have to pay taxes. There are specific laws and criteria for these. If your sole proprietorship business earns less PhP 20,000 a month (< PhP 250,000 annually), you don’t have to pay income taxes. You might be liable for other taxes though.

Also, if you opt to register an OPC, taxation will be different from a sole proprietorship. I discuss more about the difference in the article above.

Running a business is not easy. It takes a lot of time and effort in order to grow and succeed. Thankfully there are tools that you can use in your business to help you achieve your goals. Take a look at the ones I use and recommend here.