The BIR Form 0605, also known as the payment form, is one of the BIR forms you will encounter at least once a year in your business. As long as you are registered with the BIR, you will use this form at least once a year.

As with most tax forms, the best way to file is through online (via eBIRforms). And when you also need to pay for something, like a tax due, doing it via online banks or mobile wallets like GCash can help save you a lot of time.

In this guide, you’ll learn:

- Common uses of the BIR Form 0605

- Who should use this form

- Who shouldn’t use this form

- When to file and deadline

- How to file the form with examples

- Downloadable templates

- Some important notes and reminders

- Other relevant reading

Common uses of the BIR Form 0605

The payment form is commonly used for payment of the registration fee of your business with the BIR—whether that’s for new businesses or renewals. But did you know the form 0605 is also used for other purposes? Here are some of its other uses:

- Payment for penalties due to late registration of books

- Payment for penalties due to late printing of receipts

- Payment for penalties due to lost Certificate of Registration (COR)

- Payment for other penalties (late registraion of business, late submission of inventory list)

There is one common theme among them: all for payments to the BIR; thus, properly named as the payment form.

Who should fill up this form?

If your purpose falls into any one of the items above, you need to use the BIR form 0605.

When you register a business—corporation, partnership, freelancer, or a new branch—you need to use this form.

Who it’s not for

If you are a regular employee with no sideline or own business, you need not concern yourself with this form. This also applies for overseas Filipino workers (OFWs) without their own businesses.

When to file

For new businesses, the payment is made on or before 30 days of registration with the Securities and Exchange Commission (SEC) or Department of Trade and Industry (DTI) if you want to avoid incurring penalties for late registration.

For existing businesses, the payment needs to be made on or before January 31st of every year. Remember that this also holds true even if you finished registration in November of the previous year and paid the annual registration fee for a new business.

For all other situations, the 0605 form needs to be paid and filed before you accomplish what you need to. For example, you need to complete the 0605 before you can get your COR reprinted and handed over to you.

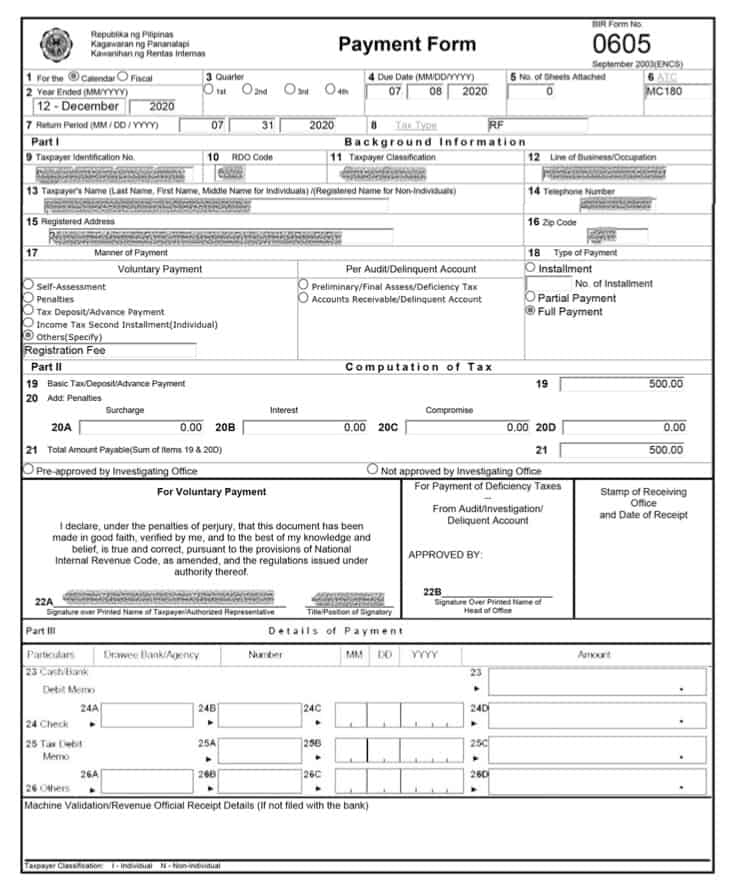

How to fill up the BIR FORM 0605 properly

Filing the BIR form 0605 involves 3 main steps.

1. Fill-up the form

The following fields are the most important ones you need to edit:

- TIN

- RDO code

- Line of business

- Registered name

- ZIP code

- Email address

- Calendar/fiscal year

- Due date

- ATC

- Return period

- Tax type

- Individual or non-individual

- Manner of payment

- Amount

After filling out all the required fields, click on validate. This is a simple check done by the eBIRForm software to check for errors. If there are errors, make sure you fix them because you won’t be able to proceed to the next step.

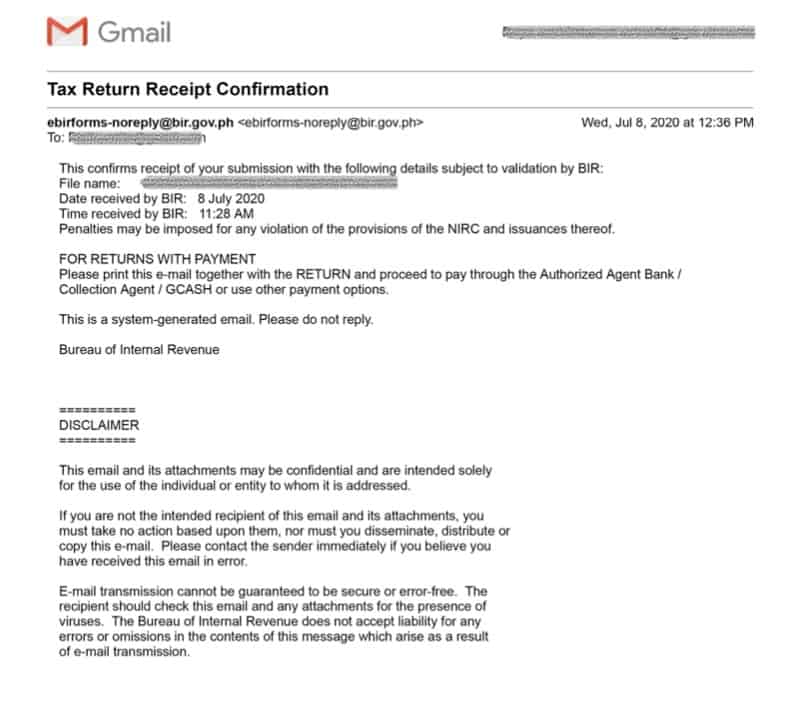

2. File the form

If there are no errors, save the form and submit. Then, download a PDF copy for your reference.

After submitting the final copy, the BIR will send you a confirmation email within the next 24 hours. Keep this for your reference.

What I typically do is create a PDF out of this email then save it in a folder together with the actual form so I can find it later if I have to.

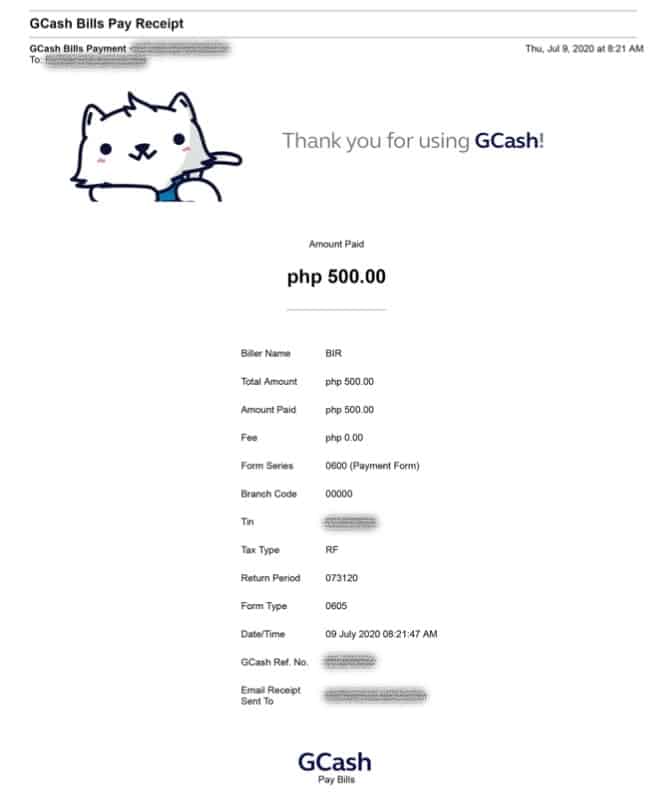

3. Pay the necessary amount

The last step in the process is to pay the amount due. If you’re paying for the annual registration fee, which is due every 31st of January every year, then you’d have to pay for PhP500.

My preferred method of payment is via GCash since I can do it wherever I am as long as I have an internet connection. Here’s how it may look like:

Of course, you can still go through the traditional route of payment via an authorized accredited bank (AAB) if you don’t mind waiting in line for a few hours just to pay a small amount.

This is usually a bank near your RDO, so if your business uses a virtual office and you live somewhere else, you’d have to travel there. Or get someone from your team (or outsourced personnel) to do this for you.

Downloadable templates

In case you need a copy of the form, you can download it directly from the BIR website. You can find both a PDF and Excel version there.

But for 90% of businesses, you shouldn’t need this 90% of the time. Use the eBIRForms instead.

Important notes and reminders

Apart from the deadlines mentioned for business registration and renewal, the only other thing you need to remember about the payment form is that you need to have it stamped by the BIR with “late filing” if you are paying penalties.

That means you need to go to your registered regional district office (RDO) first BEFORE you pay the form. Otherwise, the bank will not accept it.

Have other concerns about the BIR form 0605? Let us know in the comments below.

Other relevant reading

- RR 7-2012: Amended Consolidated Revenue Regulations on Primary Registration, Updates, and Cancellation

- RMC 57-2020: Streamlining of Business Registration Requirements and Revised Checklist of Documentary Requirements

Frequently asked questions

How do I file the BIR Form 0605

Whether you’re a new business or an existing one, you file the BIR form 0605 using the eBIRForms software. You fill it out with the important details like the examples shown here, then submit it within the system directly.

How do I pay the BIR Form 0605

To pay your annual registration or renewal fee, you can opt to go to an accredited bank (called Authorized Agent Bank or AAB) or use online banking like Union Bank or GCash instead.

13 thoughts on “BIR Form 0605: Payment Form Explained in Plain English”

If you lost the Bir form 0605 how to get a copy?

If I make a mistake in form 0605, like wrong payment details, what should I do? The payment has been done. Thank you.

TAXPAYERS RETURNS PAYMENT

if i filed it tru online and payment is tru gcash is there a need na ipareceive ko pa cya sa BIR? I submitted final copy tru online

To my knowledge, you don’t have to. Just make sure you keep your records properly. I recommend a physical copy as well as a digital copy at the very least.

Should a government employee under contract of service with 1% income tax deduction every salary are required to pay BIR form 0605?

If you lost the Bir form 0605 how to get a copy?I pay it already

pano po pagnagkamali ng enter ng year.Nalagay ko po 2021 instead of 2022 sa #4(due date) and #7 Return period.Kailangan ko po ba magreapply ulit?Nakabayad na rin po thru gcash.

How to pay for penalty for late renewal of ATP through GCash?

You determine the penalty amount first, then in GCash, you just pay the 500 renewal fee plus penalty together. It’s the same as with paying through banks. They don’t care about the breakdown. All you need to worry about is paying the full amount. Then in your BIR form, that’s where the breakdown should be.

How to determine the penalty amount?

Do i need to attach payment 0605 whenever i file 1701, 2551Q, 1701Q in accredited banks aside from the bank’s deposit slip? Thanks.

What tax type code is MC and FP?